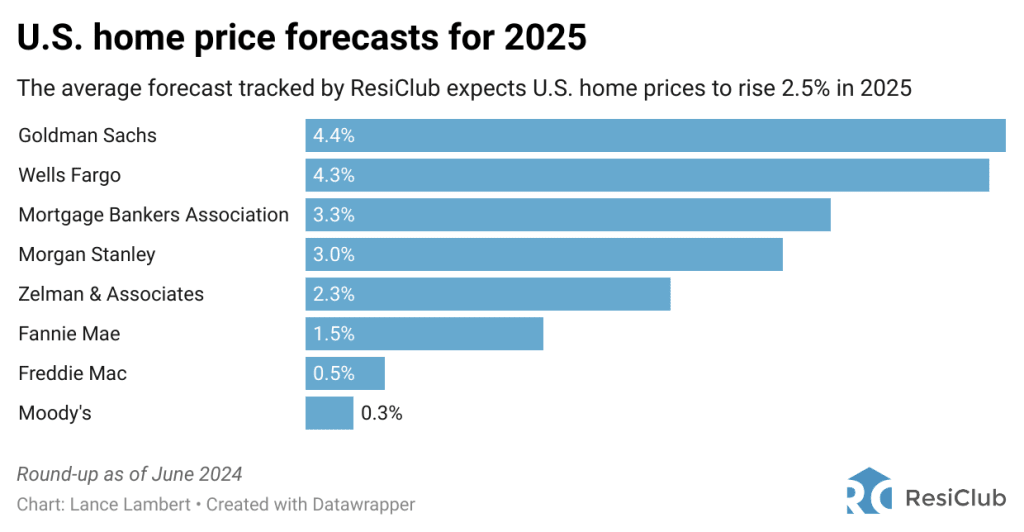

- 📈 The average forecast for U.S. home prices in 2025 expects a 2.5% increase.

- 🏡 Goldman Sachs is the most optimistic, predicting a 4.4% rise in home prices for 2025.

- 🐻 Moody’s is the most cautious, anticipating only a 0.3% increase in home prices for 2025.

- 📉 Regional markets may experience varying trends, with some areas seeing declines and others seeing high appreciation.

- ⚖️ Moody’s forecasts a period of stable prices due to affordability constraints, while Goldman Sachs predicts supply issues will drive prices up.

- 📅 The forecast roundup includes only publicly issued predictions, excluding those not aligned with the 2025 calendar year.

- 🔍 Key metrics to watch include the labor market and active inventory/months of supply.

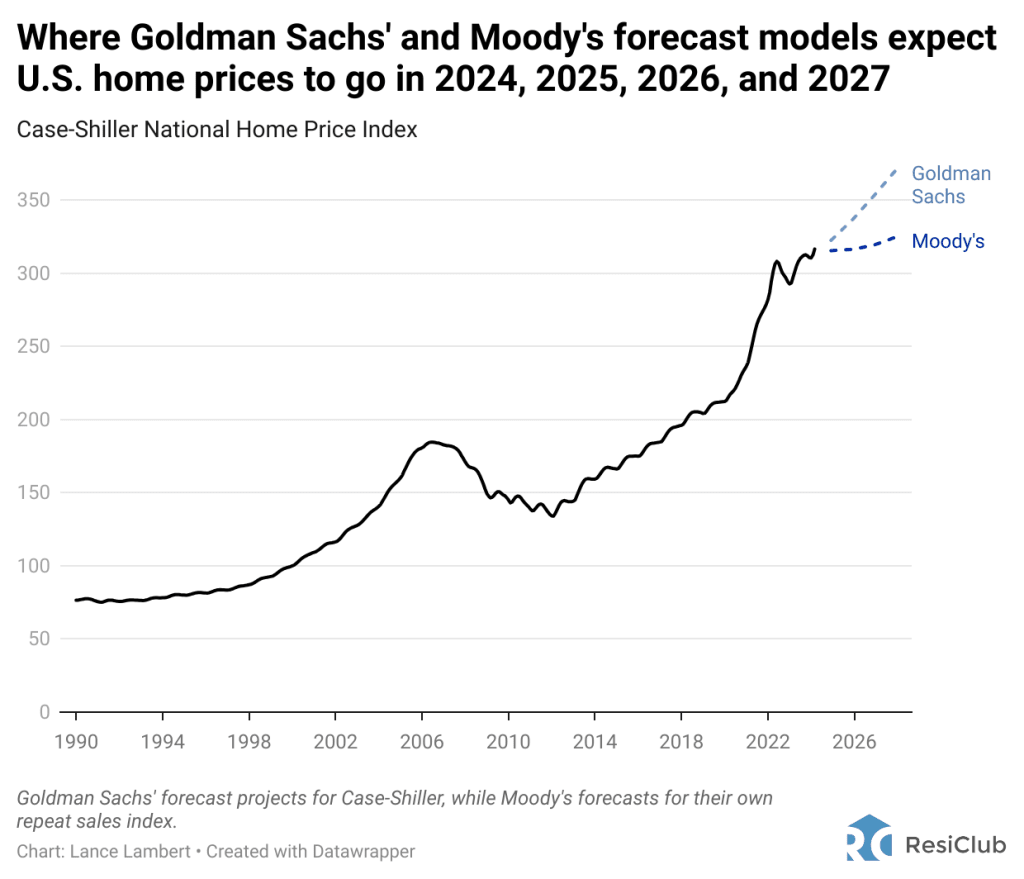

- 🌎 Goldman Sachs and Moody’s have different methodologies, with Goldman Sachs relying on the Case-Shiller National Home Price Index and Moody’s on its repeat sales index.

Navigating the housing market is always a challenging endeavor, but knowing what industry experts predict can help buyers, sellers, and investors make more informed decisions. As we look ahead to 2025, various financial institutions like Goldman Sachs and Moody’s have made their forecasts regarding national home prices. In this blog post, we’ll explore these projections, focus on key metrics, and provide actionable insights for navigating the year ahead.

Key Predictions for 2025 Home Prices

Average Home Price Increase

According to ResiClub, an aggregate of expert forecasts anticipates that U.S. home prices will rise by an average of 2.5% in 2025. While this indicates positive growth, regional trends may differ significantly.

Goldman Sachs: The Bullish Perspective

Goldman Sachs stands as the most optimistic among the forecasters, predicting a 4.4% rise in home prices for 2025. Their bullish outlook is largely based on supply constraints, suggesting that even with affordability issues, limited housing availability will drive prices upward.

Moody’s: The Bearish Forecast

On the other end of the spectrum, Moody’s offers a more cautious outlook, forecasting only a 0.3% increase in home prices for 2025. According to Moody’s, unhealthy affordability relative to incomes will constrain near-term home price growth, resulting in more stable prices.

Regional Market Variations

One of the significant takeaways from these forecasts is that regional markets may experience varying trends:

- Areas Expected to Decline: Some regional markets, especially those recently experiencing rapid price increases, may see declines.

- Continued Growth Areas: Conversely, some locales may continue to see elevated appreciation, driven primarily by local economic factors and limited housing supply.

Key Metrics to Watch

Understanding the following key metrics will be crucial for navigating the housing market in 2025:

- Labor Market: A robust labor market usually translates to more home buyers, thereby driving up prices.

- Active Inventory/Months of Supply: This metric will indicate the health of the housing market. Currently, parts of the Gulf region, including Florida’s condo market, show signs of softening.

Comparing Methodologies: Goldman Sachs vs. Moody’s

Goldman Sachs and Moody’s utilize different methodologies to arrive at their forecasts:

- Goldman Sachs: Utilizes the Case-Shiller National Home Price Index, which focuses on the variations in home values across the U.S.

- Moody’s: Relies on its Repeat Sales Index, offering a different angle on housing price trends.

Advice for Home Buyers, Sellers, and Investors

Given the diverse forecasts and varying regional trends, here are some strategic points for different stakeholders in the housing market for 2025:

For Home Buyers

- Assess Timing: If you’re planning to purchase, consider doing so sooner rather than later in regions with expected high appreciation to lock in lower prices.

- Financing Options: With the potential for stable or modest price increases, ensure you explore various mortgage options to find the best rates.

For Home Sellers

- Market Timing: In softening markets, consider selling sooner to maximize gains before potential price drops.

- Home Improvements: Minor upgrades can make your property more attractive, especially in competitive markets.

For Investors

- Focus on High-Growth Areas: Invest in regions predicted to experience significant appreciation.

- Long-Term Perspective: Even in areas predicted to stabilize, the long-term growth trend suggests a continued positive outlook.

Closing Thoughts

As we navigate toward 2025, staying informed about these forecasts and understanding key metrics will be vital for making informed decisions. Whether you are a buyer, seller, or investor, these insights can serve as a valuable guide in what promises to be a dynamic housing market.