- 🏠 Investors are “cautiously optimistic” about the real estate market.

- 📈 Majority of single-family rental investors plan to buy more properties within a year.

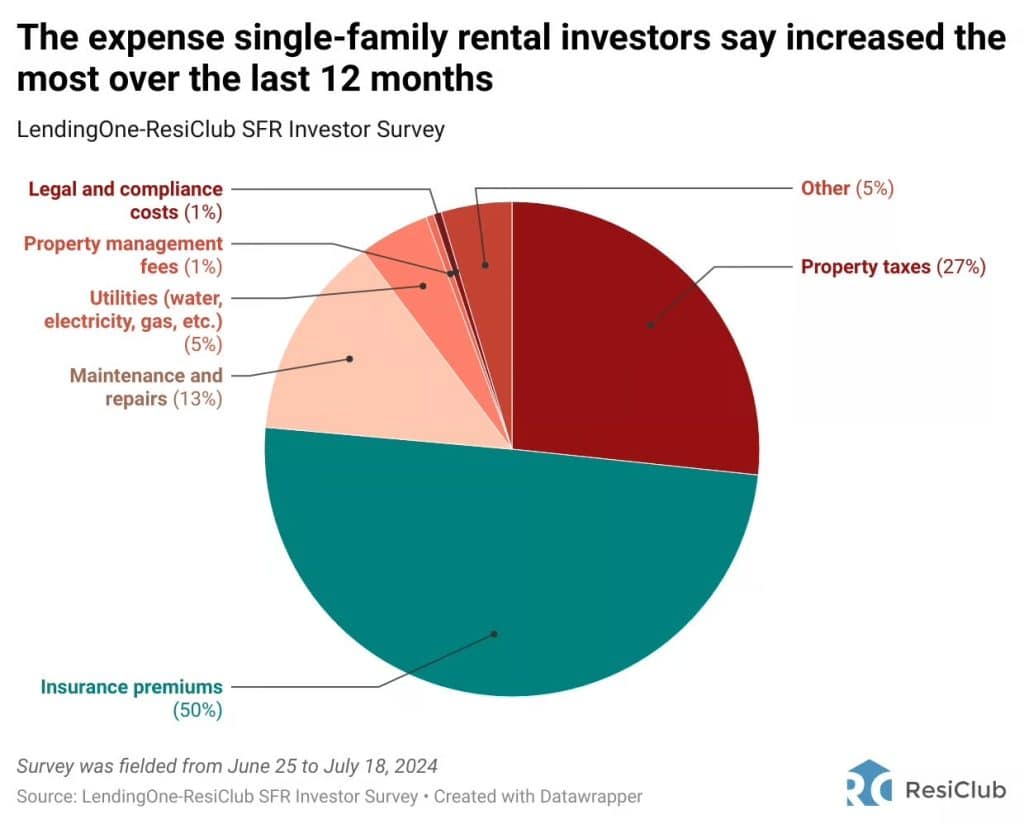

- 💸 Rising home insurance costs are a major concern for investors.

- 📉 Investors expect mortgage rates to decline in the next year.

- 💰 Most landlords plan to increase rents next year, with one-third planning increases of over 4%.

- 🚀 Insurance premiums have significantly risen, adding up to $865 for some homeowners.

- 📊 Survey shows single-family rent growth peaked at 3.2% in 2024.

- 🏗️ Small investors are increasingly filling the gap left by large institutional players.

The real estate market is brimming with potential and challenges alike. Recent surveys indicate that single-family rental (SFR) investors are adopting a “cautiously optimistic” outlook, despite rising home insurance costs and other financial hurdles. Let’s delve deeper into what’s driving this sentiment and explore how investors plan to navigate the market in the coming year.

The Current Sentiment Among Investors

Why the Optimism?

🏠 Cautiously Optimistic Outlook: According to a recent survey conducted by ResiClub and LendingOne, a significant number of SFR investors hold a cautiously optimistic view of the market. This sentiment is primarily rooted in their expectations of a balanced rental market over the next 12 months. While there are concerns, investors feel that the market will stabilize enough to offer promising opportunities.

📈 Plans for Property Acquisitions: The survey revealed that a majority of these investors plan to buy more properties within the next year. Specifically, 60% of respondents are likely to invest in additional properties, a clear sign of their confidence in the market’s potential.

Financial Concerns and Challenges

💸 Rising Home Insurance Costs: One of the most pressing concerns for SFR investors is the steep rise in home insurance premiums. Data from companies like Matic and S&P Global indicate that insurance costs have surged significantly, with some premiums increasing by as much as $865 annually. This rise in cost is particularly noticeable in states like Texas, Arizona, and Utah, where rates have doubled.

📉 Expectation of Lower Mortgage Rates: Despite the insurance challenges, investors are buoyed by the expectation that mortgage rates will decline in the coming year. The survey indicated that 86% of investors anticipate a drop in interest rates, though only 10% expect a significant decrease of more than 1 percentage point.

Rent and Revenue Projections

💰 Planned Rent Increases: Most investors plan to raise rents in the next year to offset rising costs. Around 75% of landlords intend to implement rent hikes, with one-third planning increases of over 4%. This trend is partly driven by the need to balance the escalating insurance expenses.

📊 Peak Rent Growth: The annualized single-family rent growth reached a peak of 3.2% in 2024. Major markets such as Seattle, New York City, and San Francisco have surpassed this growth rate, indicating strong rental demand. However, the highest growth was seen in St. Louis, with a 6.2% increase.

The Role of Small Investors

🏗️ Filling the Gap: Small, mom-and-pop investors are stepping up as large institutional players pull back. These smaller investors are crucial in addressing the demand for affordable housing, particularly as large-scale builders struggle to deliver sufficient inventory. According to New Western’s survey, 90% of small investors anticipate business growth in 2024, further emphasizing their importance in the current market landscape.

Key Insights and Future Trends

- Diversified Investment Strategies: Investors are increasingly diversifying their portfolios to mitigate risks associated with rising costs and fluctuating mortgage rates.

- Focus on Affordable Housing: There’s a growing focus on maintaining or increasing the supply of affordable housing, which is essential for sustaining rental demand.

- Technology Adoption: The use of technology in property management and investment analysis is becoming more widespread, helping investors make data-driven decisions.

Conclusion

The real estate market presents a complex interplay of opportunities and challenges for single-family rental investors in 2024. While rising insurance costs are a significant concern, the overall outlook remains optimistic, driven by expectations of declining mortgage rates and strategic rent increases. Small investors play a crucial role in this dynamic market, stepping in to fill gaps left by larger institutions. As the market stabilizes, investors must continue to adapt and innovate, ensuring they are well-positioned to capitalize on emerging opportunities.

By staying informed and adopting flexible strategies, investors can navigate this cautiously optimistic landscape effectively, making the most of the predicted trends and challenges.