- 💰 First-time buyers face financial challenges due to high home prices and elevated mortgage rates, needing a family income of at least $100,000 in many areas.

- 🏠 First-time buyers often live with family or friends to save for a down payment, illustrating a sensible approach to finances.

- 📈 The housing market remains competitive, requiring first-time buyers to be patient and prepared for multiple offers on properties.

- 🏢 Most first-time buyers use real estate agents to navigate their purchase, highlighting the importance of professional guidance in the process.

Entering the world of real estate as a first-time homebuyer can be both exciting and daunting. With the prospect of owning a home comes a myriad of challenges, from financial hurdles to navigating a competitive market. For those stepping into this arena, understanding the dynamics at play and leveraging available resources can make the journey smoother and more rewarding. Let’s explore the economic pressures, strategic living choices, market conditions, and the pivotal role of real estate agents in the realm of first-time homeownership.

Financial Challenges for First-Time Buyers

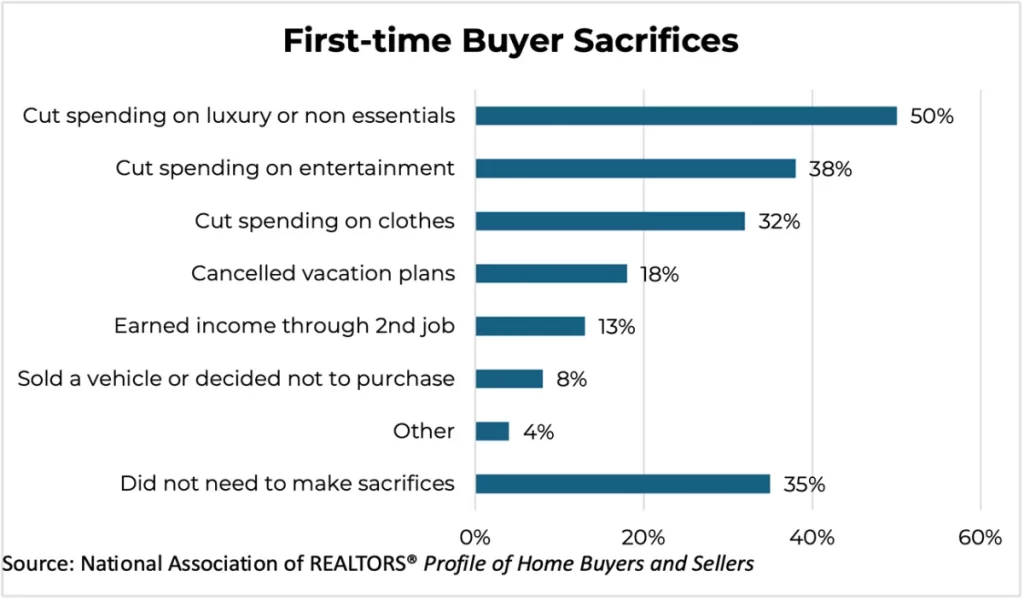

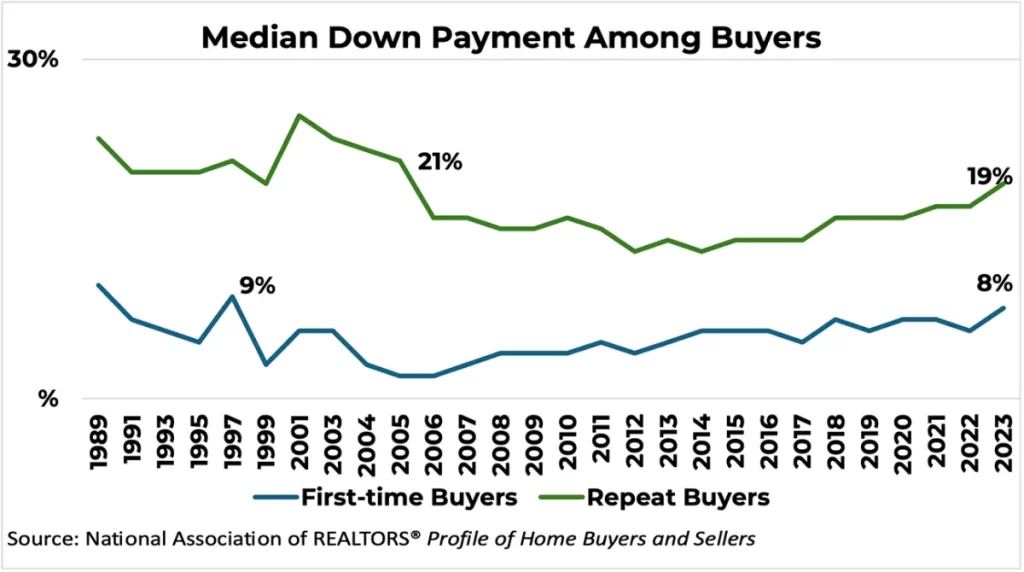

One of the most formidable barriers for first-time homebuyers is the financial challenge posed by high home prices and elevated mortgage interest rates. As property values soar, particularly in metropolitan areas, the requirement for a substantial family income becomes more pronounced. In fact, many buyers find themselves needing an income of at least $100,000 to make a 10% down payment on a home. This financial demand often necessitates significant sacrifices and savvy planning.

Tips for Overcoming Financial Hurdles:

- Budgeting: Create a comprehensive budget that includes estimated mortgage payments, taxes, insurance, and maintenance costs.

- Saving Strategies: Establish a dedicated savings plan early on, potentially utilizing high-yield savings accounts or investment portfolios designed for short-term growth.

- Assistance Programs: Investigate local and federal assistance programs tailored to first-time buyers, such as grants or low-interest loans.

Strategic Living Choices

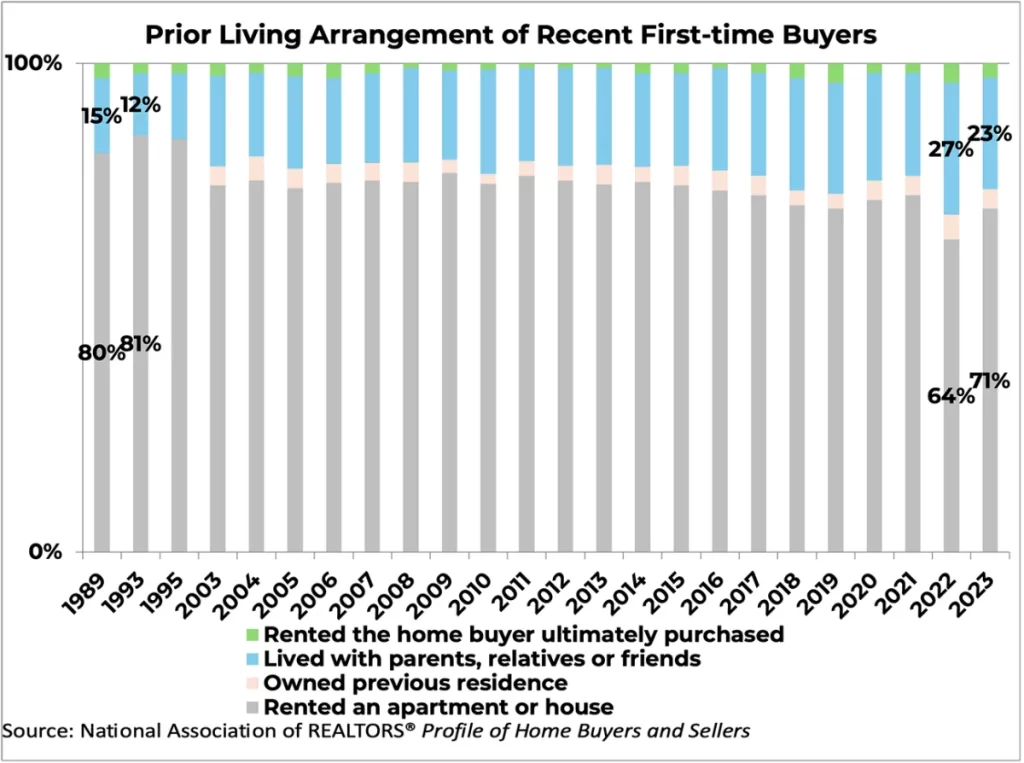

In light of these economic challenges, many first-time buyers opt to live with family or friends as a strategic move to save for a down payment. This approach can significantly reduce living expenses, allowing for a more robust savings plan.

Considerations for Co-living:

- Setting Goals: Clearly define your savings goals and timeline with household contributors.

- Financial Agreements: Consider formalizing your living arrangements with a written agreement to manage expectations and responsibilities.

Navigating a Competitive Market

The current real estate market remains competitive, characterized by limited inventory and a fast turnover of properties. First-time buyers often find themselves in bidding wars, requiring patience and persistence. The average home sells quickly, and it’s common for sellers to receive multiple offers, posing a unique challenge for those new to the process.

Strategies for Success:

- Preparation: Get pre-approved for a mortgage to strengthen your offer and demonstrate financial readiness.

- Flexibility: Be open to different neighborhoods or property types to increase your options.

- Timeliness: Act quickly when a property meeting your criteria becomes available.

The Role of Real Estate Agents

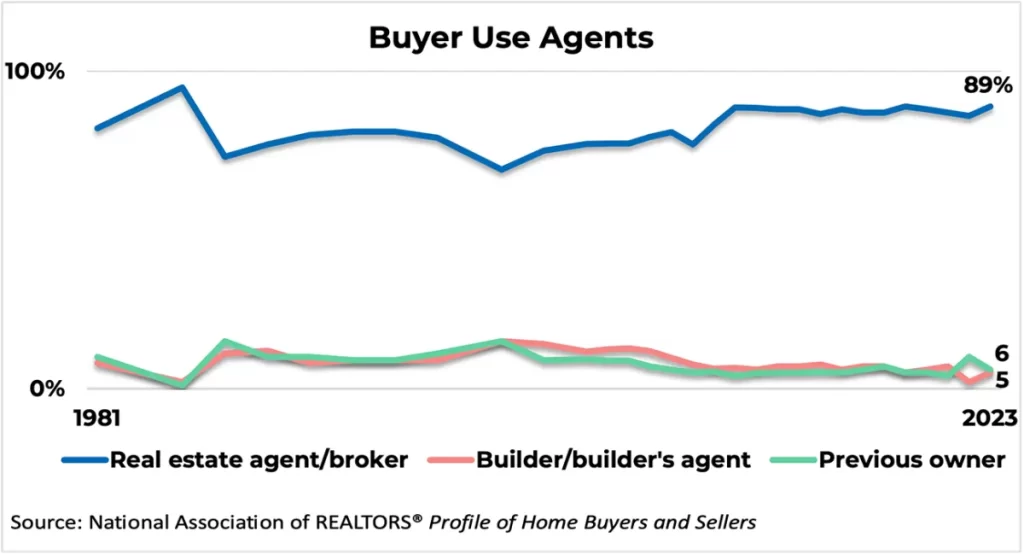

For many first-time buyers, engaging with a professional real estate agent can be a game-changer. Agents bring valuable expertise, helping buyers navigate complex transactions, understand market trends, and negotiate favorable terms. Particularly in a competitive environment, an agent’s guidance can be crucial to securing a desired property.

Benefits of Working with an Agent:

- Market Insights: Agents provide up-to-date information on market conditions and pricing trends.

- Negotiation Skills: Seasoned agents can negotiate effectively on your behalf, potentially saving you money or securing other favorable terms.

- Network Connections: Agents often have access to listings not publicly advertised and can recommend trustworthy service providers such as inspectors and lenders.

Conclusion

Becoming a homeowner for the first time is a significant milestone that comes with its unique set of challenges. By understanding the financial landscape, making strategic living choices, staying prepared for a competitive market, and leveraging the expertise of a real estate agent, first-time buyers can navigate these challenges successfully. As you embark on this journey, ensure you are armed with knowledge, patience, and a clear strategy to reach your homeownership goals.