- 📉 Bill McBride, the analyst famous for predicting the 2008 housing crash, is now focusing on housing inventory.

- 🏘️ McBride believes the current housing cycle resembles the 1978-1982 period with high interest rates and strained affordability.

- 🔨 Despite high residential construction employment, McBride suggests potential declines in employment might lead to a soft economic landing.

- 🏡 Single-family housing starts and new home sales are strong, partly due to incentives like mortgage rate buy-downs.

- 🏢 Weakness in the multi-family sector doesn’t provide strong economic indicators.

- 📊 A shift in housing inventory trends could slow down national price growth, with potential declines as months-of-supply increases.

- 🌧️ Sharp inventory increases in the South, especially in Florida and Texas, are driven by climate-related issues like destructive storms.

- 📈 McBride stresses the importance of monitoring inventory levels to predict housing market trends.

- 🌍 Long-term housing headwinds include restrictive policies on construction and climate change impacts on water availability.

- 👶 Favorable demographics and ample land supply are seen as long-term economic tailwinds.

The real estate market is ever-changing, and having an expert understanding of its trends can help navigate its complexities. Bill McBride, famous for predicting the 2008 housing crash, offers some valuable insights into the current housing market landscape. Here’s a detailed analysis based on McBride’s observations.

Bill McBride, renowned for his accurate prediction of the 2008 housing crash, now shifts his focus to housing inventory. This blog post delves into his analysis and forecasts for the current housing market, providing valuable insights for homeowners, investors, and industry professionals.

The Housing Market Resemblance to 1978-1982

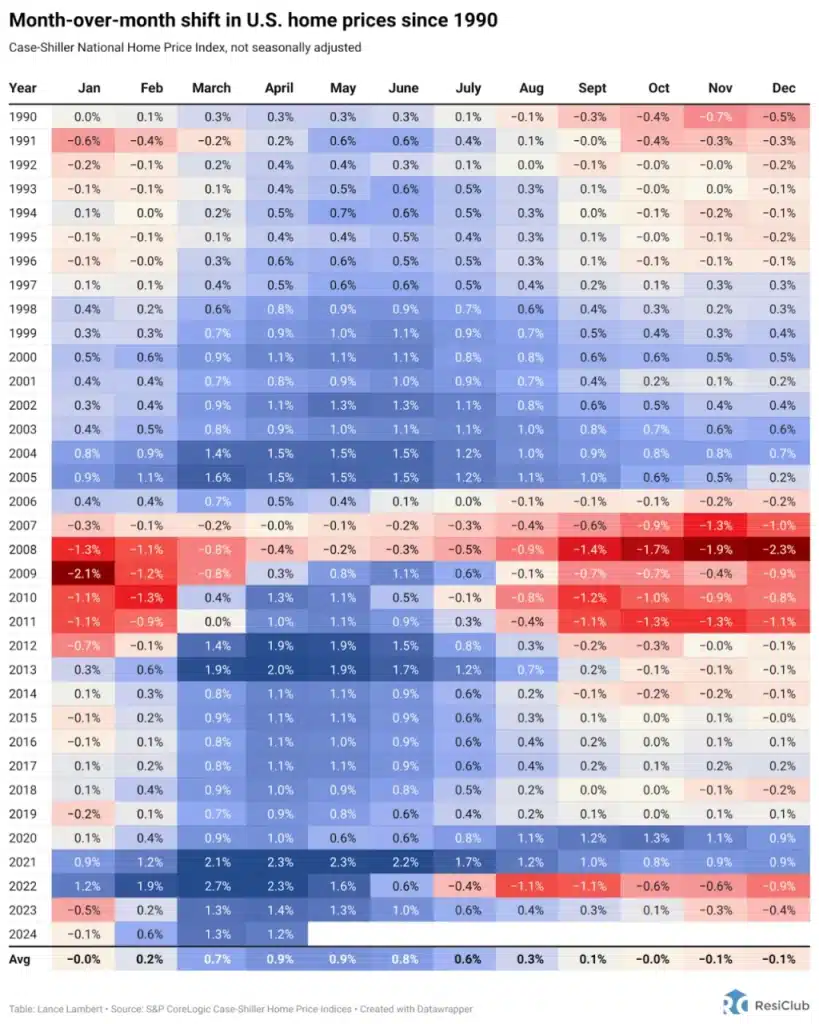

McBride believes the current housing market closely resembles the period from 1978 to 1982. This era was marked by:

- High Interest Rates: Elevated interest rates strained affordability for many potential buyers.

- Overheated House Price Growth: Rapidly increasing house prices created a sense of urgency and competition among buyers.

- Strained Affordability: High prices coupled with soaring interest rates made it increasingly difficult for people to afford homes.

Despite these challenges, McBride does not foresee a national home price crash similar to the one experienced during the 2007-2011 period. Instead, he anticipates a slower national price growth.

Economic Indicators and Construction Employment

Single-Family vs. Multi-Family Sectors

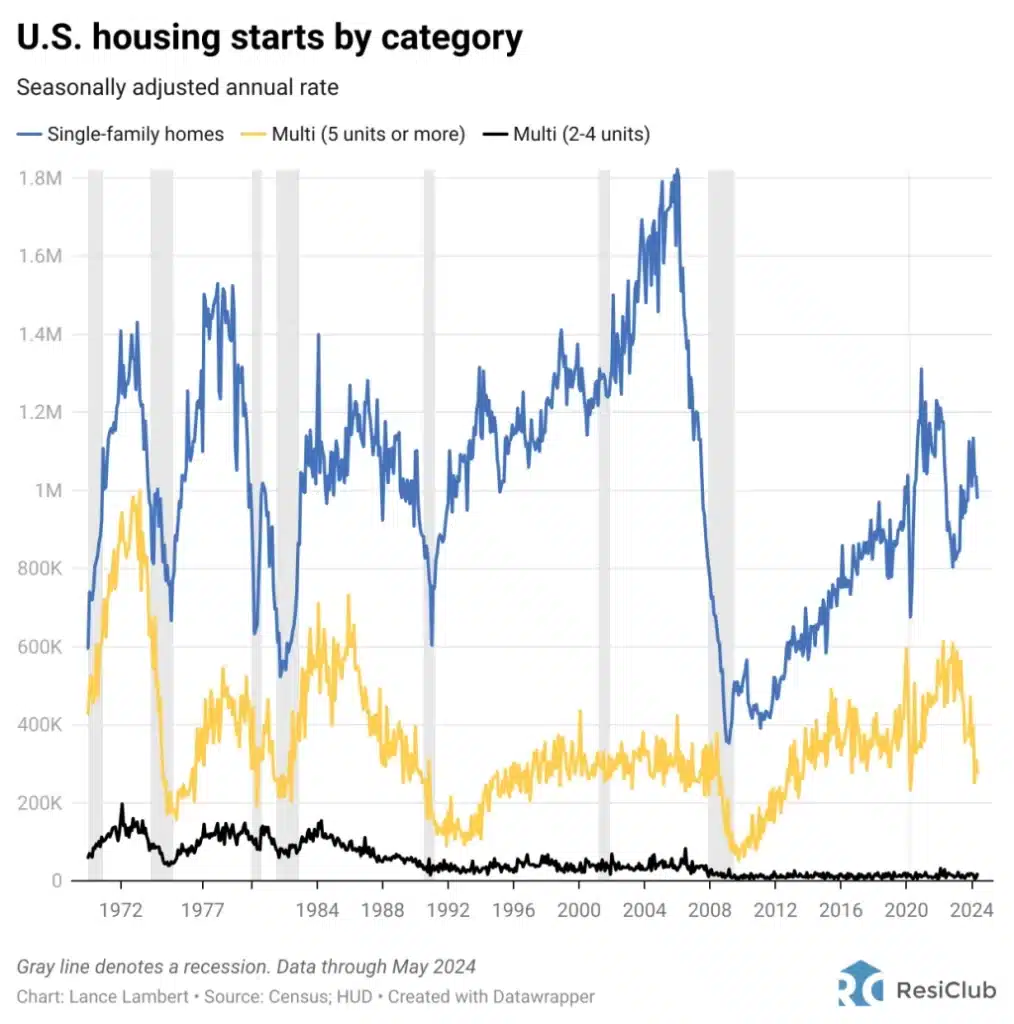

McBride points out a significant divergence in the performance of single-family and multi-family housing sectors:

- Single-Family Housing: New home sales and housing starts have remained robust. Builders are incentivizing buyers through methods like mortgage rate buy-downs.

- Multi-Family Housing: The multi-family sector exhibits more weaknesses and does not serve as a reliable economic indicator.

Impact on Employment

High residential construction employment has been maintained due to the strong performance in the single-family sector. However, McBride suggests that:

- Potential Employment Declines: As the pipeline of multi-family units gets completed, there might be declines in construction employment.

- Soft Landing: These declines might not lead to a recession but instead could signal a soft landing for the economy.

Shifts in Housing Inventory

A key focus for McBride is housing inventory. Here are his primary observations:

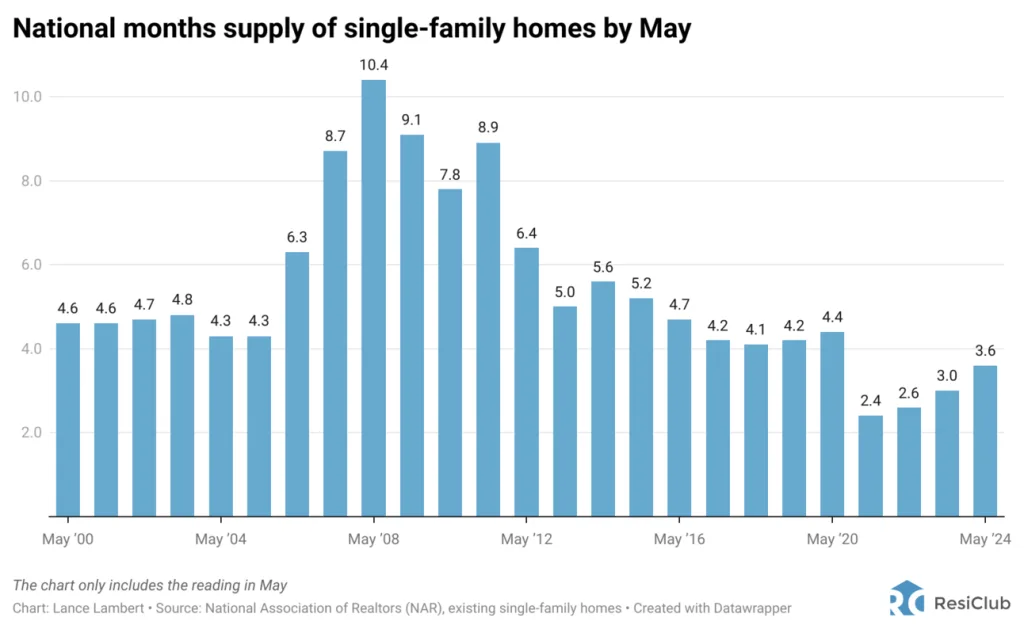

- Inventory Trends: There’s been a notable year-over-year increase in national housing inventory.

- Impact on Prices: Traditionally, house prices decline when inventory exceeds six months. However, recent trends show price declines with less than six months of supply.

McBride expects inventory levels to continue rising, potentially reaching more than four months soon. This could slow national price growth significantly and might even lead to price declines with a five-months supply.

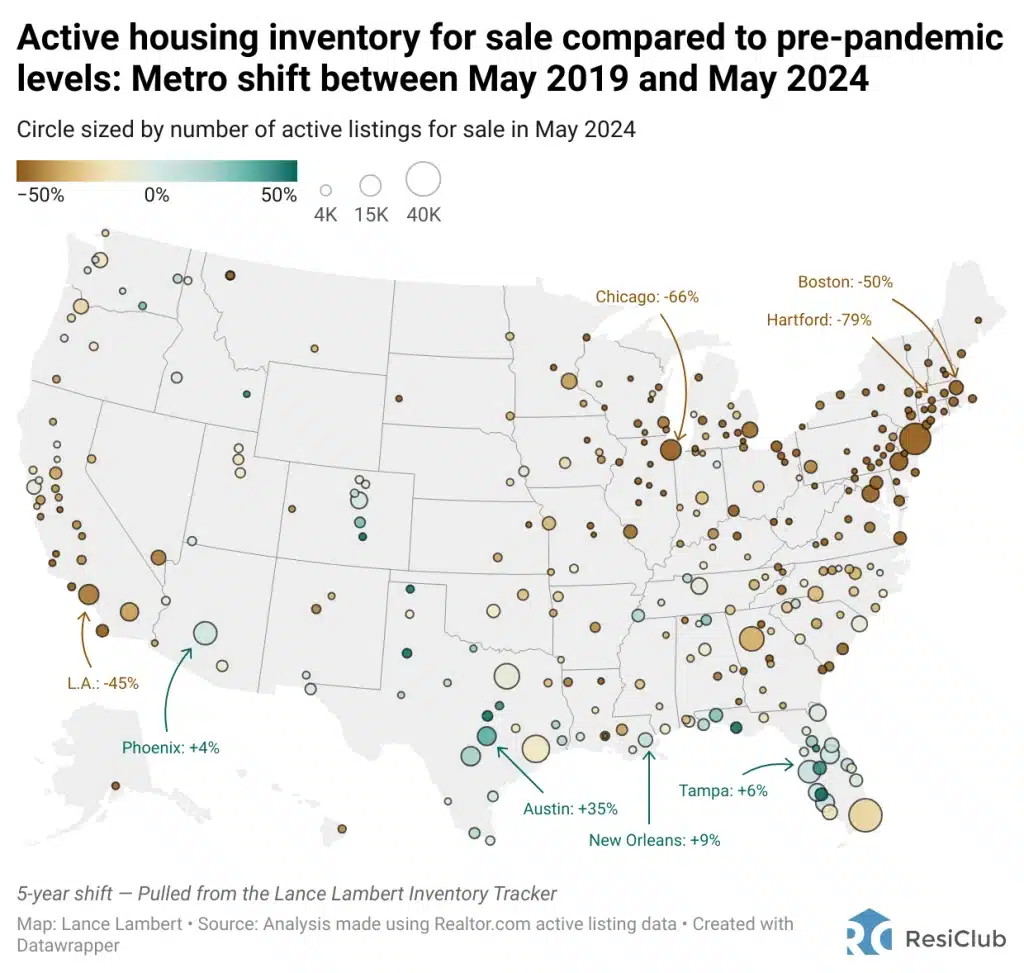

Regional Inventory Increases Driven by Climate Change

Sharp increases in housing inventory in the South, particularly in Florida and Texas, can be attributed to climate-related issues:

- Destructive Storms: Frequent, severe storms along with rising sea levels are making homeowner’s insurance increasingly unaffordable.

- Climate Change Effects: The long-term impacts of climate change are starting to make areas further north more desirable, potentially leading to regional shifts in housing demand.

Long-Term Housing Market Factors

Headwinds

Several long-term challenges face the U.S. housing market:

- Restrictive Construction Policies: In desirable areas like California, restrictive policies limit new construction, exacerbating housing shortages.

- Water Availability: In the Southwest, the scarcity of water is a growing concern.

- Climate Change: Its effects are making certain regions less desirable for long-term habitation.

Tailwinds

On the positive side, the U.S. housing market benefits from:

- Favorable Demographics: Compared to other first-world countries, the U.S. has demographic trends supportive of housing demand.

- Ample Land Supply: Regions with plenty of water and buildable land will likely see growth, further aided by climate change making some previously less desirable states more attractive.

Conclusion

Bill McBride’s expertise provides crucial insights into the current housing market dynamics. From housing inventory trends to the impacts of climate change, understanding these factors can help better navigate the complex real estate landscape. Keeping a close eye on these elements will be essential for anyone invested in the future of housing in the U.S.

Whether you are a homeowner, investor, or industry professional, staying informed can help you make better decisions in this ever-evolving market.